The combined impact of innovation brainpower, project execution capability and industrial AI-fuelled digital technology can lead to growth and market share

At the World Economic Forum’s Davos Agenda in January 2021, Bill Gates talked about the need to create a trusted global carbon market, which will spur the need to shift very large capital investments into low-carbon areas. He talked specifically about the hydrogen economy, carbon capture and energy storage, as well as “green premiums” and the need to drive the economics of new technologies through scaling and investment.

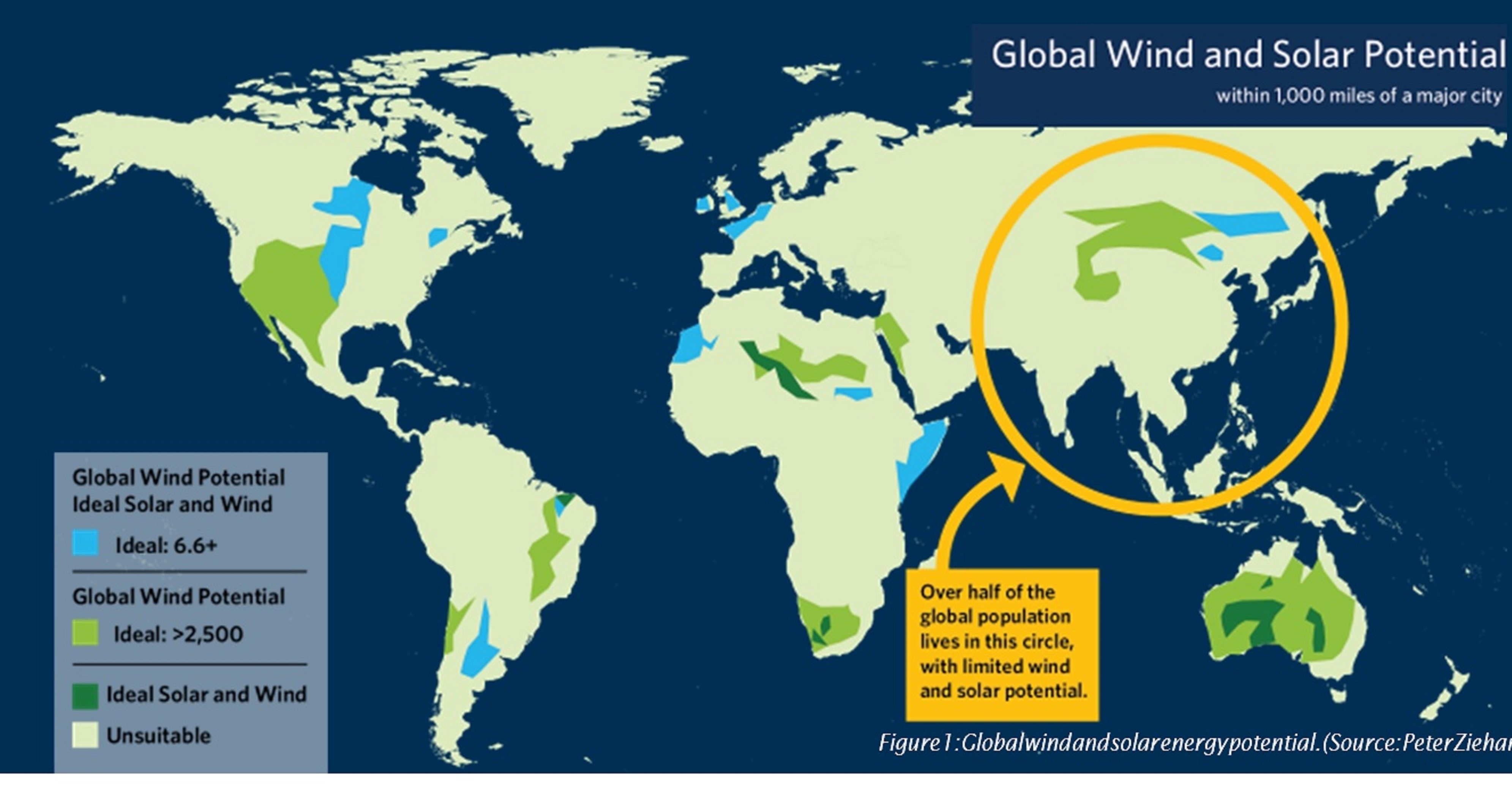

The energy transition continues to impact the economy across the energy value chain. However, renewable energy, such as wind and solar generation, are of unequal potential geographically (see figure 1). For example, many parts of Asia are challenged by limited access to locations that can generate enough solar or wind power to meet their energy requirements. Hydrogen can fill a significant fraction of the world’s need for energy and can be generated carbon-free. Despite challenges, the hydrogen economy is seeing strong momentum and possibly, as a significant zero-carbon alternative in several regions.

Hydrogen in the spotlight

AspenTech surveyed about 340 global companies in June 2021 – 65% of respondents said they were planning to invest in hydrogen in the next five years, as a solution to greenhouse gas emissions. Two-thirds of companies intend to move into hydrogen, however there is a startling divergence of approaches in this move.

Leading carbon mitigation expert Robert Socolow, Princeton University, calls this phenomenal the “colour wars” in the move towards this new hydrogen economy.

For example, 56% of companies are planning a move into Green Hydrogen, while 49% are into Blue Hydrogen, and 25% are in the established approach of Gray Hydrogen. (Note: some companies are planning multiple initiatives, which is why the percentages across Green, Blue, and Gray Hydrogen participants do not tally to a 100%).

The sustainable investment community is pushing for the Green approach, which is largely hydrogen synthesis with electrolysis fuelled exclusively by renewable energy.

However, how fast, and far can the Green approach scale? Speaking at ADIPEC in November 2021, energy guru Daniel Yergin cautioned that Green Hydrogen may be “limited by availability of green molecules”. In other words, the availability of renewable power. China has announced the country’s intention to vigorously invest in Green Hydrogen. Many energy pragmatists, including regulators in Europe, are pushing a Blue approach, which is hydrogen from known reforming processes, with retrofitted carbon capture of flue gases, which is being pursued in locations, such as Australia and Korea today. Organizations, such as PETRONAS and Reliance in Asia, are pursuing Green and Blue Hydrogen initiatives.

Overall, hydrogen should be viewed as a scalable economic innovation game with time-to-market, as a driving component. From a low-cost and non-friction scaling point of view, the most astute players see a market that is available to win.

Maximise hydrogen investments with digital technology

Software is a strategic asset.

With capital and funding to fuel the hydrogen economy, smart players are seeing the combined impact of innovation brainpower, project execution capability and industrial AI-fuelled digital technology can lead to growth and market share. Yet, there are challenges to overcome, and a silver bullet resides in digital technologies, which are mission-critical in nature.

First, it is necessary to de-risk the hydrogen economy as a system. To do so, an end-to-end systems view is crucial, which includes producing Green or Blue Hydrogen powering hydrogen production through renewables; carbon capture; hydrogen storage and transport; as well as hydrogen end use. Each component needs to be scaled, in order to succeed as a system. Beyond strong alliances and joint ventures – a quantitative approach to solving the weak points in the system is required. In fact, bulk of the available intellectual and financial capital should be applied to building a system-wide, end-to-end risk modelling. (AspenTech is working on such an end-to-end hydrogen template model approach).

Second, digital technologies can improve the economics of renewable power to hydrogen electrolysis system. While electrolysis technology works, and projects have been initiated, the associated economics do not yet provide parity with conventional energy sources. Rigorous and AI-assisted models combined with economic models – can accelerate and multiply the efforts of technology innovators to reach new levels in economic and technical breakthrough. This requires viewing renewables, power storage and hydrogen synthesis as one system that can be optimized, subject to the stochastic variabilities of wind and solar. Speaking at ADIPEC in November 2021, Thyssen Krupp’s CEO, Sami Pelkonen predicts that Green Hydrogen will reach economic parity with Blue hydrogen by 2030. Is that reasonable, and can that be accelerated?

Third, the efficiency and economics of reforming processes needs to be improved, combined with carbon capture. Technology needs to capture and remove a higher percentage of carbon dioxide produced, with better energy efficiency. Predictive rigorous models and optimization technology are key digital elements to accelerate progress and Blue Hydrogen outcomes, which involves further integration of known hydrogen synthesis processes with the less mature carbon capture processes.

Fourth, it is necessary to advance the safe handling and transport of hydrogen. Simpler and safer approaches to cryogenic hydrogen and streamlining the use of ammonia as a carrier is required. It is also mission-critical to accelerate and scale in the deployment of hybrid models combining AI with engineering domain expertise. Digital technology is helping the drive towards understanding and eliminating safety risks and controlling operations to stay within safe operating parameters.

Fifth, digital technology can help improve economics around fuel cells. Bringing advanced data analytics and hybrid models online allows manufacturers to learn from generations of fuel cell design and accelerate economic progress.

Hydrogen economy and energy transition

To achieve energy transition leadership in with industrial scale hydrogen production and carbon capture technologies, industry players will require unmatched levels of innovation, creativity, agility, and execution.

Digital technology can value-add in areas, such as time-to-market, cost of production, risk mitigation, as well as customer satisfaction. In time-to-market, it is necessary to accelerate innovation; optioneering; concept selection; and capital investment decision-making by up to 50% (or 6 – 12 months). Companies can also improve the cost of production by reducing capital cost through visual estimating; reducing operating costs by saving energy and water through optimized designs; as well as incorporate new technology to effectively integrate new and existing facilities.

Employing AI and analytics to reduce risk, while improving uptime; safety and reliability is necessary. Finally, customer satisfaction in maximizing agility and resilience in the supply chain is critical to operational excellence. Due to the complexity in energy transition, it is necessary to balance myriad objectives across a company’s assets, while taking a data-based and quantitative approach. Digitalization and Industrial AI will be critical to this balancing act.

Image Credit : Global wind and solar energy potential/source: Peter Ziehan

(Authored By: Ron Beck, Senior Director Industry Marketing and Lawrence Ng, Vice President of Sales, Asia Pacific, and Japan, Aspen Technology Inc.)

Subscribe to our newsletter & stay updated.