FY 2022-23 marked a remarkable leap with FDI doubling to Rs. 14,662 crore

Foreign Direct Investment (FDI) is regarded as a vital source of non-debt financial resources for economic development of a country. Since liberalization, FDI inflows into India have consistently increased, becoming a significant component of foreign capital. FDI brings long-term, sustainable capital into the economy, facilitating technology transfer, driving innovation, and contributing to the growth of strategic sectors like Chemicals. It also fosters competition, creates employment, and accelerates economic progress. Recognizing these benefits, the Government of India aims to attract and promote FDI to complement domestic capital, technology, and skills for rapid economic development.

Initially, FDI proposals were processed by the inter-ministerial body called, Foreign Investment Promotion Board (FIPB), housed in the Department of Economic Affairs. The FIPB was responsible for administering the FDI Policy, Press Notes, and related guidelines formulated by the Department for Promotion of Industry and Internal Trade (DPIIT). However, following its abolition in June 2017, the responsibility for granting government approvals under the FDI Policy and FEMA regulations was delegated to the respective Administrative Ministries and Departments, thus streamlining the process and reinforcing India’s commitment to a business-friendly environment.

As per the current FDI Policy goes the FDI in Chemical Sector in India is permitted 100% under the automatic route for manufacturing and trading of Chemicals (including Petrochemicals) and investor does not require any special clearances except for proposals involving investments from an entity of a country, which shares land border with India as per the press note-3. This step was taken for curbing opportunistic takeovers/acquisitions of Indian companies. Although, the majority investment is coming from automatic route where simply an Indian entity has to be incorporated with a bank account with the necessary KYC checks. After receiving the amount, the Indian entity then issues share to the foreign investor and files the FC-GPR form with the RBI to report the inflow. If the investment leads to any downstream investment, this must also be reported. To ensure ongoing compliance, entities must file the annual FLA return and maintain compliance records.

The chemical sector has been one of the key sectors for attracting FDI in the country, maintaining its rank at ninth position by the FDI amounting to US$ 22.87 billion (Since April 2000 -Sept 2024) which is ~3% of total FDI equity inflows in India.

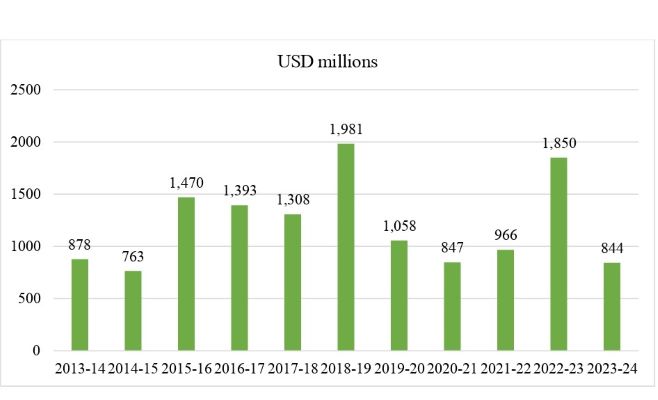

The following chart shows the FDI in chemical sector for the last 10 years:

This sector has experienced robust FDI inflows over the past three financial years, reflecting the sector's growing global appeal and the success of initiatives like "Make in India." In FY 2021-22, the sector attracted Rs. 7,202 crores (US$ 966 million) in investments, driven by global supply chain realignment and increasing domestic demand, with contributions mainly from the Netherlands, Singapore, and Switzerland.

FY 2022-23 marked a remarkable leap, with FDI doubling to Rs. 14,662 crores (US$ 1,850 million), fuelled by mega investments in organic and inorganic chemicals, plastics, and agrochemicals, led by Singapore, UAE, and Jersey. In FY 2023-24, the momentum sustained with Rs. 6,985 crores (US$ 844 million) invested, focusing on basic chemicals and plastics, primarily from Mauritius, the Netherlands, and Singapore. Currently in FY 2024-25 (till September 2024) this sector has already attracted an investment of Rs. 6,070 crores (US$ 727 million), which is at par with total FDI in the last financial year.

This consistent growth accentuates India’s emergence as a key destination for global chemical investments, bolstered by a conducive policy framework and growing market potential.

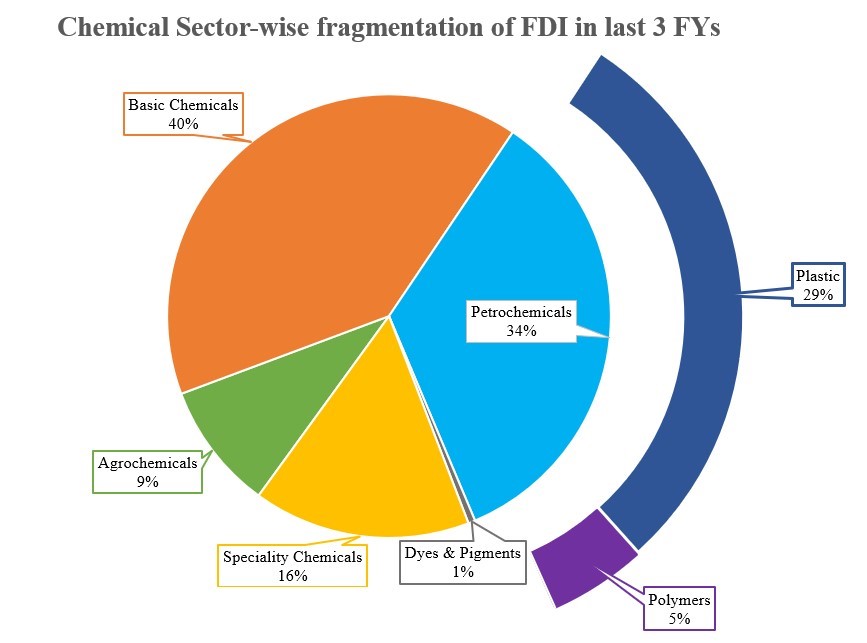

Now looking at the subsector wise analysis of FDI in the last 3 financial years. Basic Chemicals accounted for the largest share at 40%, followed by Plastics with 29% and Specialty Chemicals with 16%. Agrochemicals contributed 9%, Polymers with 5% of the total FDI, thus highlighting the sector's varied investment appeal.

This represents a compelling case for foreign investment, driven by its robust value chain in petrochemicals that caters to diverse industries such as textiles, agriculture, packaging, healthcare, and automobiles. The global shift towards Asia as the chemical manufacturing hub, coupled with India’s vast pool of skilled professionals, world-class engineering facilities, and strong R&D capabilities, enhances its appeal. With per capita chemical consumption still below global benchmarks, India offers tremendous opportunities for export-oriented manufacturing.

The Government has proactively promoted the sector through initiatives like Petroleum, Chemicals, and Petrochemicals Investment Regions (PCPIRs), Plastic Parks, and ethanol blending targets, alongside reducing over 39,000 compliances and decriminalizing 3,400 legal provisions. Also, the flagship events like India Chem and Global Chemicals & Petrochemicals Manufacturing Hub bolster investment promotion, meanwhile DPIIT has also recognized 915 chemical startups emphasising innovation in the sector. Additionally, the Department of Chemicals & Petrochemicals’ Project Development Cell ensures seamless grounding of investments, making India a transparent and investor-friendly destination for the global chemical industry.

All in all, the Indian chemical sector presents an energetic and convincing opportunity for foreign investment, supported by steady FDI inflows, a robust policy framework, and dynamic market potential, which solidify its position as a preferred destination for manufacturing.

(Keshav Shrivastava is Mid-Level Consultant -Investment Promotion, Department of Chemicals & Petrochemicals, Ministry of Chemicals and Fertilizers, Govt. of India. Views expressed in the article are personal view of the author.)

Subscribe to our newsletter & stay updated.