Crude Oil-to-Chemicals offers a path to greater refining profitability by converting lower value crude oil to higher value chemicals

A rising call for existence of human civilization and survival of life on earth in general is becoming a concern from onset of global warming, hence COP-26 convention held in Glasgow in November’2021 aimed for renewed commitment has been amplified by adherence of action oriented plans agreed upon unequivocally on global common goal on United Nations Framework Convention on Climate Change (UNFCCC) mission orchestrated through ‘The Paris agreement on the global objective of limiting the global temperature rise no more than 2oC above pre-industrial levels and pursue efforts to limit the global temperature increase to 1.5 oC’; an alignment reached by heads of countries were part of the signatories.

This has necessitated countries to declare them as Nationally Determined Contributor (NDC), made them compulsory to report national emissions; outline & communicate their climate change actions and submit results to UNFCCC secretariat at every five-year interval. This has mandated the net zero actions more pervasive, proliferating routes of alternative energy sources away from fossil fuel - be it in electricity generation or other forms energy needs e.g. transportation, powering domestic and commercial buildings, fuel for shipping etc. slated to be disrupting the refining business badly with diminishing returns from petroleum products like petrol, diesel, aviation and bunker fuel. This also necessitates repurposing existing refining product slate away from the traditional fuel business into growth oriented high margin petrochemicals product manufacturing business to cash on and by bridging the demand-supply gap likely get widened with increase of wealth, GDP growth leading to change in demography.

Having mandated by UNFCCC and subsequently declared as responsible NDC’s, many countries that are starved of crude oil, natural gas are planning to become less dependent on yesteryear’s primary source of energy originating from petroleum crudes catering to transportation, power generation etc. Alternatively, they are putting their scare resource on switching into more and more on renewable power generation e.g. solar, wind and host of other things; crafting new legislations to speed up electrification of vehicles and creating more sustainable infrastructure, deploying hydrogen as clean fuel (green, blue) for rail and road transport; legislating mandatory use of biofuel as blend stock in motor spirit etc.

Member countries are also putting thrust on energy efficiency measures through new design initiatives leveraging innovative technologies, formulating sector specific norms and rolling out plan of actions to assign targets to designated consumer to incentivise or penalize through market driven instruments fostering competition to bring down the green-house gas emissions, thereby would be importing less and less of crude oil in coming years, shall minimize currency volatility and any betterment in this endeavour will help in improving their balance of payment situation.

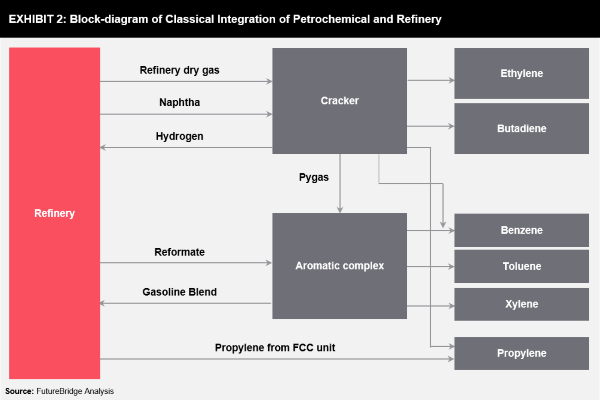

Yesteryear’s tradition in refinery configuration setting has been focussed more on maximizing production of transportation fuels. A classical refinery-petrochemical integration scheme from open source is in display to visualize and help in analyzing how interchange of streams leverages simplicity out of complexity, bring synergies and helps in optimizing Capex and Opex for any operating plant having scale and scope in simplifying their line of business processes and finally helps in improving margins: -

Technology has evolved over time, developments have been attempted successfully to process different feedstock i.e. Naphtha, gas oil and ethane. The direct use of crude oil in steam cracking for production of light olefin has not been successful on as is basis due to higher coke formation and fouling in convection section in cracking heater. However, recently there have been attempts to use light crude oil in steam cracking. This process requires preconditioning of crude oil prior to it being fed into the steam cracker.

On the other hand, Crude oil-to-chemicals (namely COTC) technology has the capacity to create new pathways, allows direct conversion of Crude oil into high-value chemicals instead of traditional transportation fuels designed for automobiles, shipping fleets and heating oils for buildings and commercial establishments. COTC enables the process of maximizing production of chemical suites exceeding 70% to 80% of the barrel as opposed to ~10% in earlier non- integrated refinery complex that we all know.

Crude Oil-to-Chemicals (COTC) is a "Transformative" technology that takes chemical production into refinery scale. It offers a path to greater refining profitability by converting lower value crude oil to higher value chemicals with a scale that would disrupt the global chemical industry, a revolutionary step in technology advancement for refinery and petrochemical integration. It has the potential to carve out more than double the profitability from a barrel of crude oil for any global refiners.

The choice of technology portfolio’s for COTC depends on the type of feedstock slated to be tied up for processing, product slates expected from the integrated Refinery-Petrochemicals complex based on their end use keeping longer term business vision with support from domestic unmet demand and keeping regional growth drivers in mind. COTC plants are primarily focused on increasing the yield of light olefins or aromatics building blocks like benzene, toluene, and xylenes. Naturally the solutions space for COTC will vary based on type of crude sourcing planned, flexibility planned to be amortized to accommodate value-addition from outsourced hydrocarbon streams being envisaged for integration and for upgrading the overall value, and for abating ESG goals.

Standalone steam cracker can be designed with multiple feed flexibility options (Mix feed, dual feed, single feed) suiting to the availability of feedstock at competitive rate for a long-term supply commitment and the feed flexibilities are as follows:

* Ethane/Propane

* Full Naphtha

* Naphtha/C3/C4 LPG

* Naphtha/Ethane

* Naphtha/NGL/AGO

Having said above, steam cracker feed flexibility and its design should have a master plan for execution with futuristic product portfolio integration for phasing out investment ideally not to exceed more than 5-7 years into its downstream business keeping a mix of commodity, basic chemicals, specialty for long-term value accruals and best possible returns from the capital employed. It is to be noted that standalone liquid cracker failed to extract value from the bottom of barrel products like carbon black feedstock and Py-Oil and it is a drawback that way which COTC plant will be at an advantage and overcome this limitation easily. In coming years only commodity products manufacturing from cracker complex will find it difficult to stay in competition and with penetration of COTC complexes in coming years likely to make it more difficult and it will face severe margin pressure.

Yield profile of chemicals from COTC project integration depends on crude assay types built into design, usually it is denoted by API gravity. It is also to be mentioned here that API gravity essentially characterises crude assay (Paraffin, Naphthenes, Aromatics and Ashphalt content) and broadly classified into four categories (Light, medium, heavy and extra heavy) Ref. classification is taken from Petroleum, UK.

API Gravity Crude type

>31.1 Light

31.1-22.3 Medium

22.3-10.0 Heavy

When we talk about crude oil characteristics linking API gravity, sulphur content is also gets associated reason being nature does not provide crude oil without sulphur attached to it and varies from 0.3% wt% to 3.0 wt% or even more at times. Therefore, few more types emerge based on the sulpher content- <0.5 wt% termed as sweet crude and >0.5 wt% referred as sour crude. Therefore, going by two broad parameters API gravity and sulphur content we termed them as sweet light, sour light, sweet heavy and sour heavy etc etc. API gravity characterizes crude where in H:C ratio becomes a fundamental parameter - varies from 4 to 1.3, a ratio of 2.0 and greater is a preferred choice for COTC complex integration for maximization of crude to chemicals which includes lighter olefins.

Now it is becoming obvious from the explanation provide above that crude selection is a key and lighter sweet crude with extra light API >31.1 should be the choice of COTC integration to minimize residue handling and its associated cost of technology integration to minimize the Capex and Opex per barrel of crude. COTC eliminates many agencies in between, minimizes the equipment count and gives enormous scope for energy integration, bring down the carbon foot-print as rejection of carbon is minimal. COTC will be a foundational change, a step forward towards the sustainability goal.

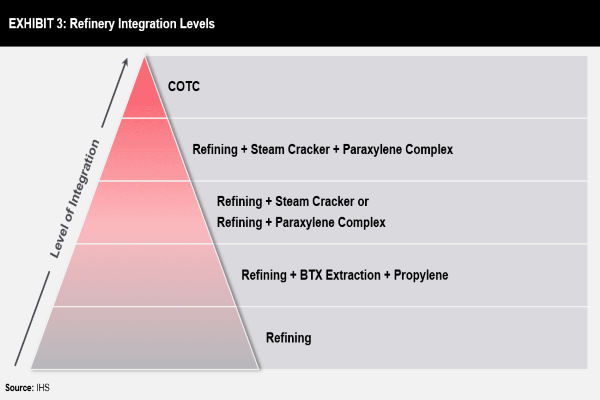

A schematic representation with hierarchy of portfolio integration is on display (source-HIS) to explain step changes on chemical yield profile that COTC provides:

Now it is becoming very clear that complexity of integration with crude types and attainment of Chemical yield does not happen automatically, requires lot of unit-operation oriented integration, fewer it is employed to serve the technology needs the better. It is also understood by now that steam cracker yields is a key to improve overall margin from COTC complex, higher it is the better; higher the paraffinic hydrocarbon provides to steam cracker, higher will be the olefinic yields and that is where the technology focus is, for attaining higher yields of light naphtha and less of heavy naphtha; less and less of middle distillates and diesel as fuel out of the entire crude basket is desirable. Upgrading crude into naphtha will require many pieces of technologies and primarily in the area of new age unique hydro-processing technology brings more transformation in molecular structure where more of hydrogen addition (hydrotreating, hydro-visbreaking and hydrocracking) and less and less of carbon rejection techniques are deployed to reduce the complexity and bring down the overall capex requirement where lot of new age catalyst will come into play.

Lot of resources in the past were deployed on research, significant capital spending done to develop new age catalyst and finally the results are extremely encouraging; commercial installation at large scale planned and it will go onstream within few years from now. Therefore, it is the catalyst core that differentiates the technology, whoever have won it, will dominate the market in coming years.

Hence, COTC requires significant refinery residue upgrading. Hydrogen addition is favored over carbon rejection as has been explained above. Hydrocracking will become one of the most important processes, due to its ability to crack, add hydrogen, removes sulfur, produce more light naphtha and at the same time achieve high conversion rate makes it very attractive.

Hydrocracking for COTC requires catalysts designed to produce more light and heavy naphtha. Targeting chemicals of desired proportion call for changes in crude selection, cheap hydrogen source and hence optimum configuration should be attempted.

Utilities consumption as a whole and its cost structure, product yields, capital investment likely to be the key determining factor for embarking such a capital-intensive project.

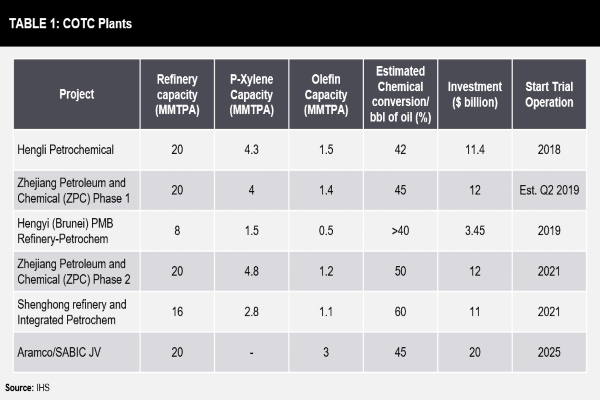

Below is the display of COTC project update sort of a ready reckoner to show how they are evolving in different parts of the globe, also taken from the open source, IHS:

Beside the COTC technology that is going to rock the stage in coming years, another ground breaking technologies which will transform the Petrochemical manufacturing from natural gas methane to ethylene and become integral to steam cracker. This technology ‘Oxidative decoupling of methane’ is showing enormous promise and where surplus natural gas is available they will be able to capitalize it better and dependence on crude will also go down for manufacturing of ethylene which is major building block for birth to many petrochemicals.

Given the range of approaches on emerging retrofit options for operating refineries, a single strategy is unlikely to work for all those who are envisaging to repurpose their product basket. Some refineries may not be candidates for a major shift to petrochemicals by virtue of their scale, specificity to their site constraints, design configuration in place; they will have to consider clubbing with other synergistic strategies for survival or even plan to exit from refining business.

For those that are ready for a crude-to-chemicals shift, number of factors will underpin their decision about the best way forward.

Subscribe to our newsletter & stay updated.