The existing O2C operating team will be moving with the transfer of business and there will be no dilution of earnings or any restriction on cash flows, RIL said in its statement.

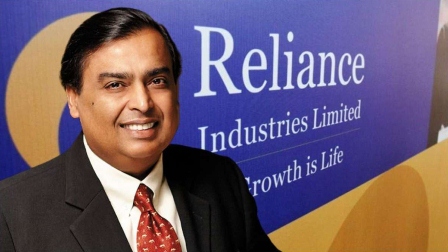

Reliance Industries Limited (RIL) has announced the demerger of its oil-to-chemicals (O2C) business into a wholly-owned subsidiary. The company expects to get the necessary approvals for O2C business spin-off by the second-quarter of the next fiscal year.

RIL will retain 100 percent management control in the subsidiary which will take charge of all of RIL’s refining, marketing and petrochemicals assets that include the world’s largest refining complex at Jamnagar and global-scale petrochemical units, it said.

In a late-night filing to stock exchanges, the company said the reorganization would enable a focused pursuit of opportunities across the O2C value chain, improved efficiencies through a self-sustaining capital structure. "Reorganisation of O2C business facilitates participation by strategic investors and marquee sector focused investors," it added.

The move is expected to facilitate value creation through strategic partnerships, including the deal with Saudi Aramco, and attracting dedicated pools of investor capital. The company said that talks with Aramco are still on. The world's largest crude oil exporter Saudi Aramco is in the process of picking up a 20 per cent stake in RIL's O2C business.

RIL has also extended an interest-bearing loan of $25 billion to the O2C business. The loan to the O2C business will be paid as and when strategic investors come in.

RIL said it has already received a nod from the Securities and Exchange Board of India and stock exchanges for the reorganisation. However, it is yet to get a clearance from equity shareholders and creditors, the income tax authority and National Company Law Tribunal (NCLT) benches in Mumbai and Ahmedabad.

The existing O2C operating team will move to the newly created subsidiary with the transfer of business, but there will be no dilution of earnings or any restriction on the cash flows, RIL said.

The presentation suggested that RIL and its O2C subsidiary will work together to move towards the net carbon-zero targets by 2035. To achieve this, the O2C business will invest in the next generation carbon capture and storage technologies to convert carbon dioxide into useful products and chemicals. It will also accelerate the transition from traditional carbon-based fuels to a hydrogen economy, RIL said.

Click here to get a copy of the presentation.

Subscribe to our newsletter & stay updated.