The company recorded highest ever quarterly revenue for O2C business despite a volatile environment.

Oil-to-telecom giant Reliance Industries Ltd has registered a jump of 53% in its gross revenue at Rs 242,982 crores (US$ $ 30.8 bn ) during April – June 2023. EBITDA for the quarter is Rs 40,179 crores ($ 5.1 bn), higher by 45.8%. The company registered a net profit of Rs 19, 443 crores ($ 2.5 bn), higher by 40.8%. The company recorded highest ever quarterly revenue for O2C business despite a volatile environment.

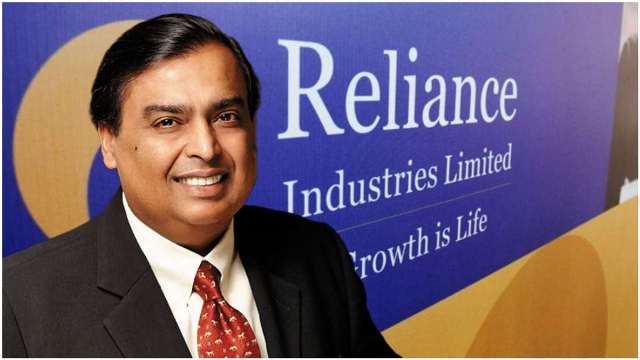

"Despite significant challenges posed by the tight crude markets and higher energy and freight costs, O2C business has delivered its best performance ever. I am also happy with the progress of our Consumer platforms," said Chairman and Managing Director Mukesh Ambani in a press statement.

During the quarter, the O2C business delivered its best-ever quarterly performance with all-time-high Revenue and EBITDA. “Segment Revenues for 1Q FY23 increased by 56.7% Y-o-Y to Rs 161,715 crore primarily on account of higher crude oil and product prices. Benchmark Brent crude average price was up 65% Y-o-Y to $ 113.9/bbl.

“Segment EBITDA for 1Q FY23 improved by 62.6% Y-o-Y to Rs 19,888 crore primarily on account of sharp rise in transportation fuel cracks and better volumes. The EU embargo on Russian oil products,higher gas to oil switching, strong travel demand and lower product inventory levels resulted in tight fuel markets. Downstream chemical profitability was stable with strong PX, PTA and PET deltas offsetting weak polymer and downstream polyester deltas on Y-o-Y basis,” the company said.

On O2C operation, RIL maintained high utilization levels across sites and units. Total throughput (including refinery) was 19.7 MMT, marginally higher than 1Q FY22. RIL Cracker operating rate was at 87% for 1Q FY23 on account of planned shutdown at Hazira (4Q FY22 - 99% and 1Q FY22 – 95%), which resulted in lower polymer production for the quarter. Aromatics production was rationalized with diversion of reformate for gasoline blending on favourable economics. “Increased utilization of gasifiers helped reduce costly liquid fuel consumption and eliminated high-cost LNG imports,” RIL said.

On the business environment, RIL says that the global oil demand in 1Q FY23 rose by 1.6 mb/d Y-o-Y to 97.8 mb/d, due to strong demand recovery in Asia, improved air travel demand in Europe and US alongside seasonal demand. Easing of lockdown restrictions in China in later part of quarter also contributed to demand recovery.

“Crude oil benchmarks soared Y-o-Y due to EU acceptance of sanctions on Russian Oil, nominal supply increase from OPEC, limited OPEC+ spare capacity and strong demand recovery. Global refinery throughput was higher by 1.7 mb/d Y-o-Y at 78.8 mb/d in 1Q FY23, reflecting tight market conditions. Domestic demand of HSD, MS & ATF increased Y-o-Y by 20.4 %, 29.4 % and 86.0 % respectively,” it said.

The company states that domestic polymer demand improved during the quarter with increased economic activities. During 1Q FY23, Polymer demand improved by 9% Y-o-Y and was 8% above pre-COVID level with domestic markets witnessing healthy demand from sectors like agriculture, consumer durables, automotive, ecommerce food packaging and infrastructure.

“PE margin averaged $ 415/MT during 1Q FY23 as against $ 325/MT in 4Q FY22 and $ 508/MT in 1Q FY22. Sharp increase in Naphtha prices impacted delta on Y-o-Y basis. Naphtha prices averaged $ 827/MT in 1Q FY23, up 39% Y-o-Y.

“PP margin averaged $ 421/MT during 1Q FY23 as against $ 412/MT in 4Q FY22 and $ 652/MT in 1Q FY22. Higher feedstock prices impacted margin on Y-o-Y basis.

“PVC margin averaged $ 576/MT in 1Q FY23 as against $ 450/MT in 4Q FY22 and $ 689/MT in 1Q FY22. Y-o-Y decline in margin was led by reduction in PVC price and sharp increase in naphtha price.

“US Ethane prices increased to 58.5 cents per gallon, up by 127% Y-o-Y and 46% Q-o-Q in line with higher US LNG prices amidst uncertain geopolitical situation. RIL continued to optimize cracker feedstock (Ethane vs Naphtha) to maximize value.

“Logistics constraints, higher ocean freight and regional availability constraint continued to support domestic prices. Robust supply chain network and superior customer service supported optimum product placement in domestic market. RIL continued to maintain leadership position in domestic polymer market,” it said.

Subscribe to our newsletter & stay updated.