The extension of PLI scheme to chemicals and the development of PCPIRs, complemented by tailored incentives for the industry, would have been beneficial for the industry

Economic Landscape

The Modi government unveiled the Union Budget 2025, marking its second budget since the central elections the previous year.

Budget 2025 was presented against a diverse global economic landscape, with some regions showing signs of recovery and growth while others grappled with economic headwinds and uncertainties. In this backdrop, India's economy showcased its resilience by navigating through international challenges such as geopolitical tensions, sanctions on Russia, the Red Sea crisis, and the repercussions of rising energy prices and higher interest rates that slowed down global commerce.

Despite the prevailing global economic fluctuations, India maintained a consistent trajectory of economic growth. While the International Monetary Fund (IMF) has projected the world growth of 3.3% for 2025, India’s real GDP growth is estimated to grow by 6.4% in FY 2025.

Dynamics of the Indian Chemical Sector

The chemical sector is a fundamental pillar within the Indian economic framework, playing a pivotal role in contributing to the country's financial stability and growth. India ranks as the sixth-largest producer of chemicals globally and the third-largest in Asia, thereby positioning the country as a key contributor to the international value chain.

As a critical input to various other industries, the chemical industry not only fuels the manufacturing sector but also provides essential materials for numerous products and services. The share of chemicals and chemical products sector in the Gross Value Added (GVA) of manufacturing sector (at 2011-12 prices) was 9.5% during FY23.

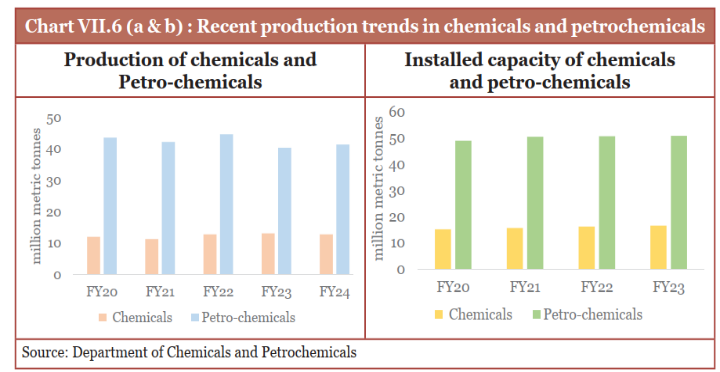

During the past decade, the production landscape across various industries has changed, with a marked increase in output towards the chemical sector. This industry's extensive reach and its integral position in the supply chain makes it an indispensable element of India's economic landscape, driving innovation and creating opportunities for import substitution, thereby working towards the goal of Aatmanirbhar Bharat.

Having said the above, the chemical sector has been facing certain obstacles impacting accelerated growth and profitability. The industry could benefit from world-class infrastructure, in the area of chemical plug-and-play parks having proximity to ports and feedstock. Fluctuating costs of essential raw materials and operational costs, especially logistics, has impacted the industry’s profit margins. Additionally, the industry is under immense pressure on account of low-cost chemicals from China.

The Indian chemical sector's ability to thrive is contingent upon addressing these challenges effectively. This may involve policy interventions, industry collaboration, investment in infrastructure and innovation to improve efficiency, reduce costs, and enhance the sector's overall competitiveness.

Stimulus Required for Growth

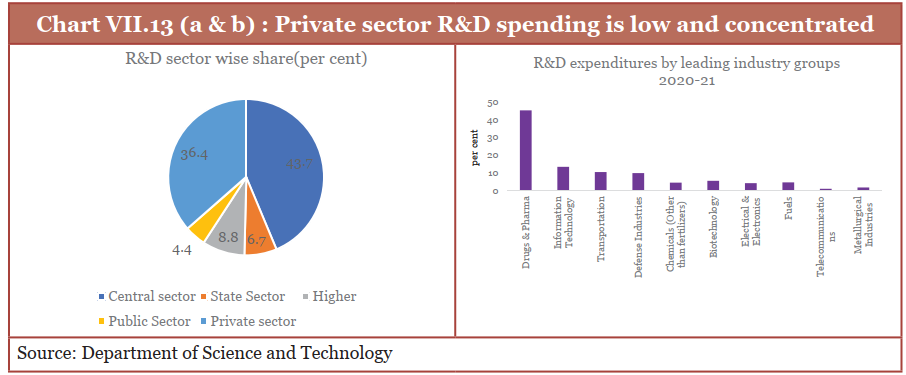

To overcome the above obstacles and improve the potential to drive enhanced value generation, the industry has been advocating for targeted policy measures by promoting fair trade, preventing dumping and extending the much-awaited Production Linked Incentives (PLI) scheme to the chemical sector which would encourage domestic production and reduce import dependency. The industry also anticipated introduction of initiatives to improve infrastructure within Petroleum, Chemicals and Petrochemicals Investment Regions (PCPIRs), establish port-connected chemical 'plug-in' hubs and streamline the inverted duty structures. There was an expectation for enhancing tax deductions to incentivise R&D which would boost private sector participation in R&D spending which is currently low especially in the chemical sector.

Source: Economic Survey 2024-25 released by the Indian government

Sector specific reforms and the much-awaited PLI scheme, remain an unfinished agenda and would have provided the much desired stimuli for a sector which has been bravely bracing headwinds through challenging times. Nonetheless, the reforms proposed in the Budget 2025 will augment consumption-driven manufacturing and agriculture sector growth, indirectly giving an impetus to the chemical industry.

Key policy announcements relevant for chemical sector

Budget 2025 has laid out several policy measures which will provide a direct or indirect impetus to the chemical industry:

Introduction of schemes such as Prime Minister Dhan-Dhaanya Krishi Yojana which aims to achieve agricultural productivity, crop diversification, improved irrigation facilities and setting-up of urea plant will boost the demand for fertilizers and agrochemicals.

The government proposes to launch the second Asset Monetization Plan targeting INR 10 lakh crore over FY25 to FY30. The government has various public sector undertakings in this sector such as Gujarat Narmada Valley Fertilizers & Chemicals Limited, Gujarat State Fertilizers and Chemicals Limited, Gujarat Alkalies and Chemicals Limited, Indian Farmers Fertiliser Cooperative Limited (IFFCO), Krishak Bharati Cooperative Limited (KRIBHCO), Rashtriya Chemicals & Fertilizers Limited. Should any of these companies be part of the aforesaid monetization plan, it could impact the chemical sector by attracting private investment in public sector undertakings and fostering public-private partnerships. This could lead to modernization, increased competitiveness and innovation within the sector.

Launching of 6-year “Mission for Aatmanirbharta in Pulses”, National Mission on High Yielding Seeds and 5-year mission to facilitate improvements in productivity and sustainability of cotton farming will support development of eco-friendly and efficient agrochemicals and a focused increase in R&D within the chemical sector.

Announcement of National Manufacturing Mission will further the 'Make in India' initiative. This initiative is expected to bolster the chemical industry which is the cornerstone for all manufacturing sectors.

The aim to build the ecosystem for solar PV cells, EV batteries, motors and controllers, electrolyzers, wind turbines, very high voltage transmission equipment and grid scale batteries will positively impact the chemical sector.

Additionally, the National Action Plan for toys scheme is likely to benefit the specialty chemicals sector, while a 3-year pipeline of PPP infrastructure projects promises to boost demand for construction chemicals.

The establishment of an Export Promotion Mission for MSMEs will significantly aid the Indian chemical industry, particularly the smaller players. By providing easy access to export credit, it will offer the necessary financial support for these companies to enter and compete in international markets.

Revamping of the current model of Bilateral Investment Treaties to make them more investment-friendly can create a conducive environment for growth and development in the Indian chemical industry, enabling it to become more competitive on a global scale while also protecting domestic players.

The promotion of Global Capability Centres in emerging Tier 2 cities can help the Indian chemical industry by providing access to trained resources, driving efficiency and cost savings, fostering innovation, and contributing to a more resilient and diversified industrial landscape.

Setting up of National Centres of Excellence for Skilling will support in achieving the ‘Make in India’ goal which in-turn will have a positive impact on the chemical sector.

An allocation of INR 20,000 crore has been proposed to implement private sector driven research, development and innovation initiative. Where any amount out of the aforesaid budget of INR 20,000 crore is allocated to the chemical sector, the same will certainly provide impetus to R&D based innovation and value creation in the sector.

The government has announced the proposal to set up Deep Tech Fund of Funds. This Fund could enable catalyzing more innovation in the next generation startups in the chemical industry.

The government also plans to broaden the scope for fast-track company mergers and streamline the approval process, making it more efficient, which is expected to enhance the ease of doing business in India.

Tax reforms proposed in Budget 2025

Key Direct tax proposals

While there were no changes in the corporate tax rates and provisions in Budget 2025, it was announced that a new Income Tax Bill will be released. The new Income Tax Bill 2025 has been tabled by the Hon’ble Finance Minister before the Lok Sabha on 13 February 2025. The said Bill will be applicable from 1 April 2026.

The intent of the newly introduced Income Tax Bill 2025 is to make the income tax law simple, straightforward, minimize litigation and remove redundant provisions in the existing Income-tax Act, 1961. The new Income Tax Bill 2025 is accordingly intended to be aligned with the Income-tax Act, 1961 on all substantive policy aspects like residency rules, scope of total income, computation and heads of income, assessment provisions, etc. However, in the process of redrafting for simplicity or reducing litigation, certain changes having an impact on corporate taxation, personal taxation, transfer pricing, corporate reorganization and procedural provisions are reflected in the provisions of the new Income Tax Bill 2025 vis-à-vis the existing Income-tax Act 1961 which will necessitate an impact assessment.

It is expected that the Parliamentary Standing Committee formed to vet the new Income Tax Bill 2025 may hold another round of stakeholder consultations before making its recommendations for consideration by the Government. The revised bill will then be approved by the Parliament and enacted into law post the Presidential assent.

There are certain amendments proposed in Budget 2025 which are aligned to the objective of reducing compliance burden, resolving the hardships being faced by the taxpayers, encouraging voluntary compliances, improving the ease of doing business in India, etc. Some of the proposed key tax amendments relevant to the sector are as under:

(a) The government has reduced personal income-tax rates and introduced new slab which will entail no income-tax for income upto INR 12 lakh under the new tax regime. The reduction in personal income-tax rates and the new tax slab can indirectly benefit the chemical sector through increased disposable income, leading to higher consumer spending. This can boost demand across the sector, stimulate economic growth, and encourage investment in housing and construction, which uses many chemical products.

(b) Provisions related to Tax collected at source (TCS) on sale of goods have been removed thereby reducing the compliance burden on the taxpayers and the said amendment will also reduce the pressure on working capital.

Key Indirect tax proposals

(a) The reduction in Basic Customs Duty (BCD) from 10% to 7.5% on various chemical compounds, including Aminophylline, Trimethoprim, Diethyl carbamazine citrate, 1-Amino-4-Methyl piperazine, and other compounds containing an unfused triazine ring, will help the Indian chemical industry by lowering production costs, enhancing competitiveness, stimulating production and investment, and potentially driving innovation.

(b) The specific entry that imposed a higher Basic Customs Duty (BCD) rate of 10% on imports of Phosphoric Acid originating from or exported by the United States has been deleted. Consequently, BCD rate of 5% will be applicable to Phosphoric Acid imports from any country, including the USA. This change is expected to benefit the Indian chemical industry by lowering costs, streamlining the import process, and foster a market that is both more competitive and diversified.

(c) Further, the rationalization of overall customs duty on laboratory chemicals, which includes a reduction in the effective custom duty rate (BCD plus Agriculture Infrastructure and Development Cess plus Social Welfare Surcharge) from 155% to 140%, is likely to reduce costs, promote research and development, enhance competitiveness, and support the broader ecosystem that relies on these chemicals, thereby benefiting the Indian chemical industry as a whole.

(d) The exemption of BCD for cobalt powder and waste, scrap of lithium-ion batteries, lead, zinc, and twelve critical minerals is likely to reduce costs, promote recycling, enhance competitiveness, attract investment, support innovation, and contribute to supply chain security in the Indian chemical industry.

(e) The introduction of new tariff entries for certain dual-use chemicals, aimed at addressing the challenges exporters face due to export control regulations are likely to enhance the efficiency, compliance, and competitiveness of the Indian chemical sector in the global export market.

Conclusion

Given the prevailing challenges being faced by the chemical industry, the extension of PLI scheme to chemicals and the development of PCPIRs, complemented by tailored incentives for the industry, would have been beneficial for the industry. These measures would have provided an impetus to domestic manufacturing, drawn considerable investments, and fostered an environment favourable to innovation, expansion, and enduring progress.

While the industry was anticipating more direct support through these specific measures, the various announcements in Budget 2025 that aid the MSME and energy sectors, encourage research, development, and innovation, and focus on skilling a large workforce, are set to bolster domestic demand and exports and indirectly provide an uplift to the chemical industry.

Subscribe to our newsletter & stay updated.