Factors such as high inflation across major economies, disruptions stemming from the Russia-Ukraine war and competition from low-cost Chinese products impacted the industry performance

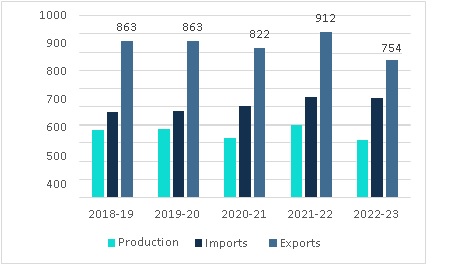

India's position as one of the leading global suppliers of D&P is evident through its major exports to countries like Bangladesh (11% of total D&P exports during FY23), followed by China (6%), Turkey (6%), USA (6%), and Indonesia (3%). However, during FY23, the industry encountered various challenges, including a significant decline in exports (see chart below) and a moderation in profitability.

Source: CMIE

These challenges were primarily caused by a rise in inflation and an uncertain geopolitical landscape resulting from the Russia-Ukraine war. The war led to economic sanctions imposed on several countries, sharp volatility in commodity prices (including crude oil), and supply chain disruptions. Consequently, major global economies, particularly the USA and Europe, experienced recessionary trends that affected the demand for D&P from the textile industry, which accounts for over 70% of the overall consumption.

Furthermore, the industry faced competition from low-cost Chinese products, as China’s consumption declined due to Covid-19-induced restrictions. This intensified the competitive pressure on Indian exporters in the global market.

As a result, the industry witnessed a moderation in profitability and had to navigate through a challenging business environment during FY23.

H1FY24 to Remain Muted, Demand Revival Likely in H2

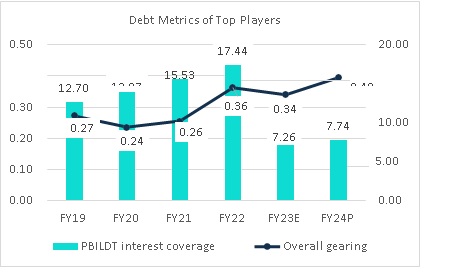

Owing to the aforementioned challenges, the TOI of major industry players declined by over 5% during FY23, with around 400 bps contraction in operating profitability (see chart below). The headwinds are expected to persist in H1FY24 leading to continued muted demand. This along with correction in input prices might pose a challenge in destocking of inventory which would keep profit margins under pressure in the first half of FY24. During H2FY24, revival is expected with a pickup in demand from the textile industry and benefit of stabilization of input prices, mainly crude. Crude after reaching a high of over 120 USD/ Barrel in FY23, has stabilised to ~78 USD/ Barrel in Q1FY24.

In FY24, volume is expected to grow by 5-7% whereas PBILDT margin is likely to witness recovery of 100-150 bps over FY23. Traction in the textile industry is expected owing to restocking of inventory by various channel partners, softening of cotton & crude oil prices and onset of festive season. Also, benefit of gradual shift of global demand of D&P to India is expected with the adoption of the China plus One strategy by major world economies.

Comfortable Solvency Position expected to continue

Major players in the D&P industry operated at a comfortable leverage of ~0.3x as on FY23 end with interest coverage of ~7x, underlining their healthy financial risk profile. While debt-funded capex is being undertaken by a few players in FY24, leverage is expected to remain comfortable at 0.4x at the end of FY24 along with stable interest coverage at ~8x. The said capex largely entails expansion of the product portfolio, enhancement of production capacity and backward integration.

Source: CareEdge Ratings & Stock Exchange filings

Note: Analysis of sample set of major players in the D&P industry, which constitutes more than 60% of the total industry in terms of production volume.

Interest coverage improved in the last few years amidst Covid-19 pandemic-related interest moratorium, availability of low-cost debt and release of pent-up demand post Covid. During FY23, it witnessed a sharp downfall due to significant moderation in profitability and a rise in average interest rates by ~250 bps but remained comfortable at 7x. The same is expected to remain on similar line even in FY24 despite debt funded capex, owing to some improvement in profitability.

“The Dye, Dye Intermediates, and Pigment industry is poised for recovery after the challenges faced in FY23. The demand from the textile industry is expected to improve in H2FY24, though H1FY24 may remain subdued. This anticipated rebound should result in moderate volume growth and a slight improvement in profitability as input costs stabilise. Further, the major players in the industry are likely to maintain comfortable debt protection metrics with controlled leverage and stable interest rates. This positions them well to handle any capital expenditure or incremental working capital requirements.

CareEdge Ratings' rated portfolio observed moderation with the Modified Credit Ratio (MCR) declining below unity during FY23. However, with the expected improvement in the current fiscal year, the credit risk profile of major players is likely to remain stable in the near to medium term. Having said this, small to mid-sized industry players with a more leveraged capital structure may continue to face vulnerability amid the ongoing headwinds,” Said Kalpesh Patel, Director at CareEdge Ratings.

Subscribe to our newsletter & stay updated.